Financial Planning & Analysis Professional (FPAP) -Program Overview

Best for: Those wanting an FP&A self-study program that also offers multiple courses and certifications beyond just FP&A. Best value for the price.

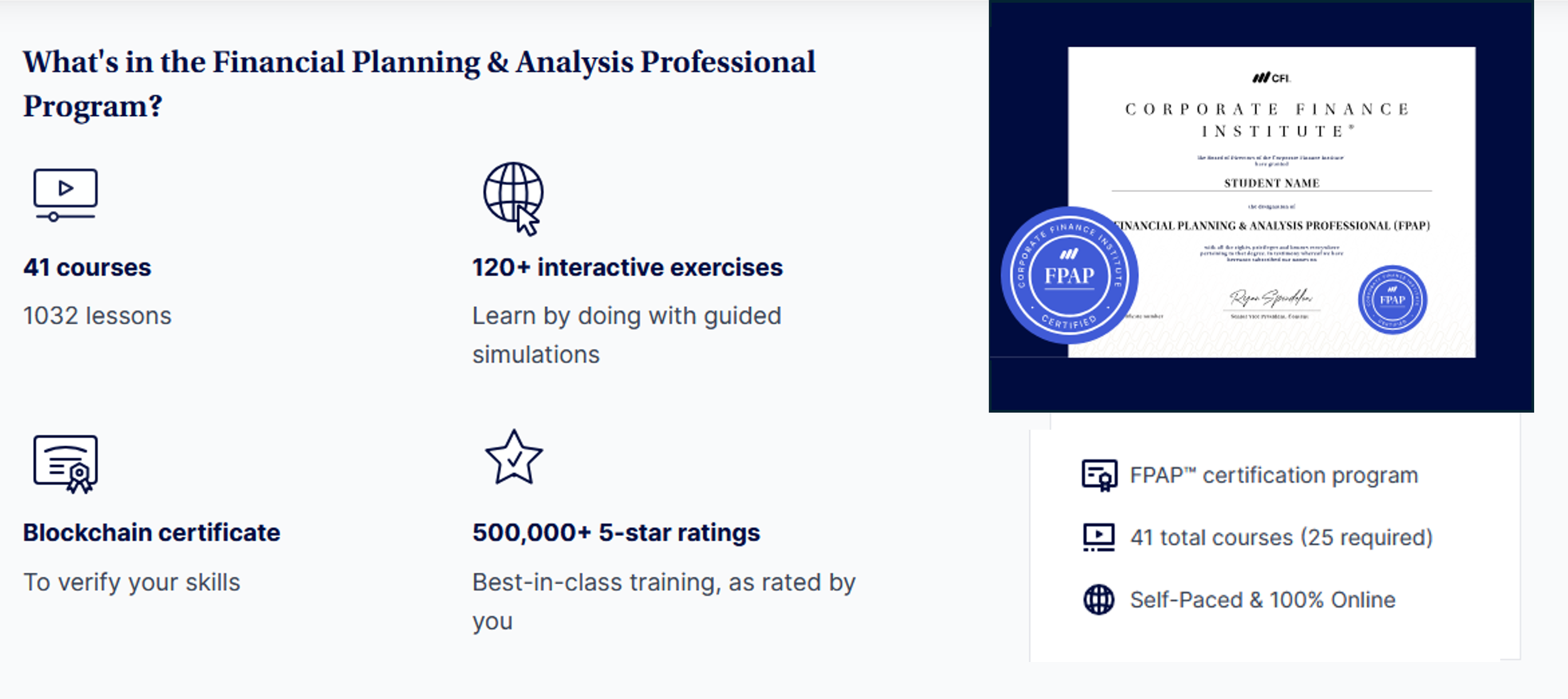

Program Name:

Financial Planning & Analysis Professional (FPAP)- Certification

Program Type:

Certification Program

Eligibility Requirements:

The Financial Planning & Analysis Professional (FPAP) from the Corporate Finance Institute (CFI) is open to anyone interested in financial planning and analysis. No formal prerequisites are required, though a finance, accounting, or business background is recommended to maximize learning outcomes. The CFI provides several courses that one can take prior to starting the program to prepare oneself.

Duration:

The program is 100% self-paced and can be completed at your own pace. It requires the completion of a minimum of 28 online courses, including 25 required and 3 optional courses out of 15 available options.

Time Commitment:

The typical time it takes to complete the program is between 50-100. The average student spends 5- 8 hours per week on the material.

Cost:

$497 yearly - Self-study platform

$847 yearly - Full-Immersion platform

DISCOUNT: Use code FPA35 for 35% off this week only and then FPAGUY30 for 30% off going forward.

Certificate Overview:

The FP&A Professional certificagtion by CFI is a professional development program designed to build essential skills for financial planning and analysis roles.

Upon completion, participants earn a globally recognized certification that can enhance their credentials and career prospects in FP&A roles.

The program requires the completion of 28 courses.

Program Curriculum:

The FP&A Professional program is divided into several core modules and courses. The learning covers six areas and is broken out as follows:

Financial Modeling: Approximately 24% of the material focuses on Financial Modeling and helping you build FP&A Models and how they differ from other financial models

Excel: Approximately 24% of the material focuses on Excel and helping you understand how to best use Excel to build financial models and complete Financial analysis.

Business Partnering: Approximately 14% of the material focuses on business partnering including how to build strong relationships and communicate financial insights to non-financial stakeholders.

Financial Analysis: Approximately 14% of the material focuses on financial analysis, including how to conduct both quantitative and qualitative analyses and craft clear, insightful commentary for stakeholders.

Budgeting & Forecasting: Approximately 14% of the material focuses on Budgeting and forecasting, including how to implement various forecasting methods to enhance the reliability of your financial models and how to provide value-added variance commentary.

Storytelling and Data Visualization: Approximately 14% of the material is focused on helping you build compelling visuals and craft data stories that help move the business forward.

Key Features:

The yearly fee includes access to all courses, certifications, and specializations

Flexible, on-demand learning platform with annual access to course materials.

Earn CPE credits

Online community

Live office hours

200+ on-demand courses

Strengths:

Includes many top-notch instructors, including

➡️ Carl Seidman,

➡️ Glenn Hopper

➡️ Scott PowellProvides a lot of excellent Excel tips, tricks, and ideas for bringing structure to your financial model.

The workflow best practices course is beneficial, covering topics such as auditing, naming conventions, formatting, and efficiency hacks.

I appreciate that they thoroughly covered all the components of building a financial model. In particular, building up the P&L portion and then including the payables and cash items, all within each schedule.

I liked the FP&A tools selection and storytelling course as I taught them :).

Value is hard to beat, given the amount of content you get from this certificate and all the other programs within the CFI library.

Opportunities/Things to Remember:

I would have liked to see the budget model section include content on how to build the P&L for each individual cost center, as this was missing.

Power Query should be a required course not an elective.

On the model rollforward, I would have liked them to show a method that involved storing all the data in the table. I did not find the approach particularly useful and would do it differently.

Provide more in-depth information on how to forecast headcount, including various methods such as capacity-based, role-based, and name-based approaches, along with a template illustrating each approach.

More in-depth information on different revenue approaches. A course covering the key different types of revenue streams, how to forecast them and watch-outs.

The FP&A Guy’s Thoughts:

Bottom line is they have a solid program here, and someone looking to learn about FP&A will come away with valuable learnings at a great price.

It is not the most rigorous of programs. I found both the FPAC and the AFM to be more rigorous, which is to be expected, as they are credentials/validations versus a training program with a certification.

If you have questions about this program or any of the other programs, feel free to email me at pbarnhurst@thefpandaguy.com

Overview of the CFI FMVA and FP&A Specialization Programs with actual students of the program.